According to Forbes, the average cost of studying abroad was $17,785 per semester in 2014.

Depending on where you go to school – whether in-state or out-of-state, private or public – studying abroad could actually save you money.

For instance, if you went to Tulane University where the tuition fee per semester is $31,555 (that’s right, per semester) you would be saving money. But we know that’s not the case. Statistically most students go to an in-state, public school where the price tag for tuition is right around $9,410 per academic year. Which means the cost of studying abroad is usually multiplied by 3 if your an in-state student!

For those who are curious, the average cost of attendance at a private school is $32,405 and $23,893 per year for out-of-state respectively.

To ask how students finance study abroad programs is like asking how students pay for college. There are thousands of articles, books, and videos on the subject.

Financing study abroad is constantly being debated and talked about in the news right there with healthcare and gas prices. The good news is that if you do decide to become one of the growing number of international students, there are scholarship opportunities (merit scholarships, as well as need-based), grants, federal student loans, private study abroad loans, federal loans for parents, and countless other financial aid packages that are set aside specifically for you that would otherwise not be available.

All are designed to cover the costs of students studying abroad. You’re almost certain to be eligible, but to receive any type of student aid, you need to apply. Keep in mind that to be considered for federal aid, you must complete the Fee Application for Federal Student Aid (FAFSA). For guidance navigating all your education and financial assistance options, just talk with a financial aid counselor in your school’s financial aid office, or with a study abroad advisor.

Here is a look at the four biggest ways students are financing study abroad:

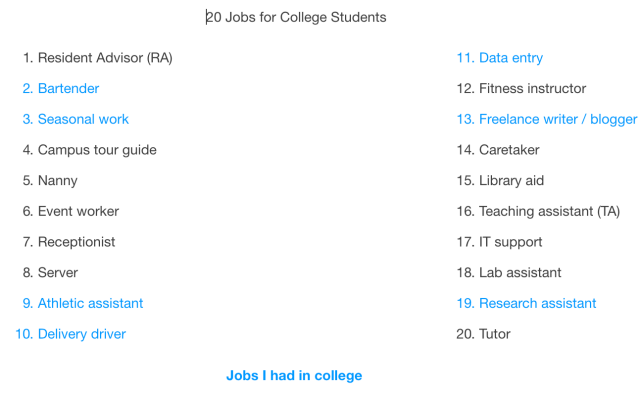

Self-financing

71 percent of college students have jobs, with most working about 15 hours a week to help with expenses. Most likely you are either in the service industry (server/bartender), have an internship, or hold some kind of work study. There are obviously many other jobs undergrads hold to cover program costs, but those are the three main ones. It may seem like a drop in the bucket to the $17,785 price tag of a semester, but every little bit helps. Here is a little secret: You don’t have to stop working while getting an education and enjoying an unforgettable experience abroad. Most students either don’t realize they have the option to work, or simply don’t want to, but it is certainly an option.

Not too long ago I had a conversation with a friend about exchanging Christmas gifts with his parents while in college, and how it really didn’t make sense. “No matter what I buy them, I am buying it with their money,” he’d say. “The same goes for birthdays.” This is true for 77 percent of families, so don’t feel like you’re alone. Don’t fret about asking your parents to help out. Once you decide to study abroad your parents will be just as excited as you are. This a good thing.

Scholarships and grants

Only 23 percent of students are aware of the scholarships and grants available specifically for students who want an international experience. If you apply and you’re not a complete neanderthal, you will probably receive some kind of aid. Think of it this way,

if only 23 percent of students are aware that these scholarships exist you have automatically eliminated 77 percent of your competition. It is one of those scenarios where simply showing up is enough. Hurry up and make a decision soon, though. The number of students studying abroad is gradually increasing.

How Your Peers Are Financing Study Abroad

Financial aid

Why are you in school right now? Why are you paying all this money for tuition fees and going into debt? I’ll tell you why – it is an investment in your future, and more importantly, yourself. You are buying resources, experiences, and guidance. When I see a majority of students graduate without getting the experience of a semester program, a full academic year, or even a summer abroad, it makes me cringe. If you need additional financial assistance to study abroad, by all means, take it. But don’t take my word for it. Ask around, and find others who have studied abroad. What was their experience like? If you find anyone who wasn’t happy with their experience or regretted going please ping me, I would love an introduction.

It doesn’t matter how you decide to finance your time abroad as long as you decide to actually go. I had a friend who would give plasma to pay the dues for his fraternity. The point is that many students have come before you who have had less money in the bank, been more in debt, and still not regretted going. It’s not a question of “How can I afford it?”. It is a question of “How can I afford not to?”

8 Alternative Ideas for Financing Study Abroad

If you think outside the box, there are even more ways to augment your study abroad expenses. Get creative and you probably will come up with any number of ideas based on your personal skill set and interests, but to get you started, here are the top eight:

1. Host A Fundraising Dinner

Or a brunch. Invite all your friends and even your best-liked professors and other faculty members. Then cook an inexpensive, yet delicious, meal and ask for a donation. If you’re feeling adventurous enough, prepare the cuisine of the country that’s soon to be your home. Guests can bring their beverage of choice. Don’t feel like cooking? Make it a Fundraising Party.

2. Send Letters to Family and Friends

Everyone needs a hand now and then and it never hurts to ask for financial support, especially from loved ones who want you to succeed. They’re all rooting for you! Just be sure to clearly express your needs and intentions and, of course, why you want to study abroad. If you create a compelling case, how can they turn you down!

3. Run For a Cause

People usually are willing to pledge to a cause. Get them to sponsor you in a running race, bike race, dance-a-thon – whatever you’re into.

4. Take on Odd Jobs

Are you a handy person? Have a special skill? This is a great way to fill in your study abroad expense gaps. Check sources like Craigslist, local job boards, and school job boards for temporary, limited-term, or one-time odd jobs. Or spread the word that you’re available for a particular kind of work. An added plus is that you often can stake on these occasional jobs as they fit your schedule.

5. Sell Your Work

Promote your art or crafts expertise and sell the goods you’ve created. Maybe you paint or draw, or do graphic design. You might sew or knit, or do woodworking projects. Take photos and market your masterpieces. Sell them and use the funds to help cover the living expenses of your study abroad program.

6. Use Social Media and Create an Online Funding Campaign

There are a variety of online fundraising campaigns. Choose one and share it across your social media platforms. Set your funding goal and explain it, and be sure to state how you plan to use the funds once they have been raised. For a personal touch that’s a real plus, you can even post a short video.

7. Have a Garage Sale

Clean out your closet, your living room, your basement, your garage (and your car) and create your own second-hand shop. Find out if your neighborhood has a community sale and join in, or simply organize your own. Ask family and friends if they have anything they’d like to donate. They will be thrilled to help you reach your study abroad education goals and just may jump at the chance to clear out their clutter, too.

8. Trade in Your Car

Really! Think about how much you spend on gas, maintenance, insurance, and parking, not to mention unexpected repairs. You won’t need a car during your time away. While living among the permanent residents of your chosen country, enjoy the bonus of temporarily foregoing the worries of car ownership. And, before your departure, do the environment and your health some good by using public transportation.